Hello Aave Community!

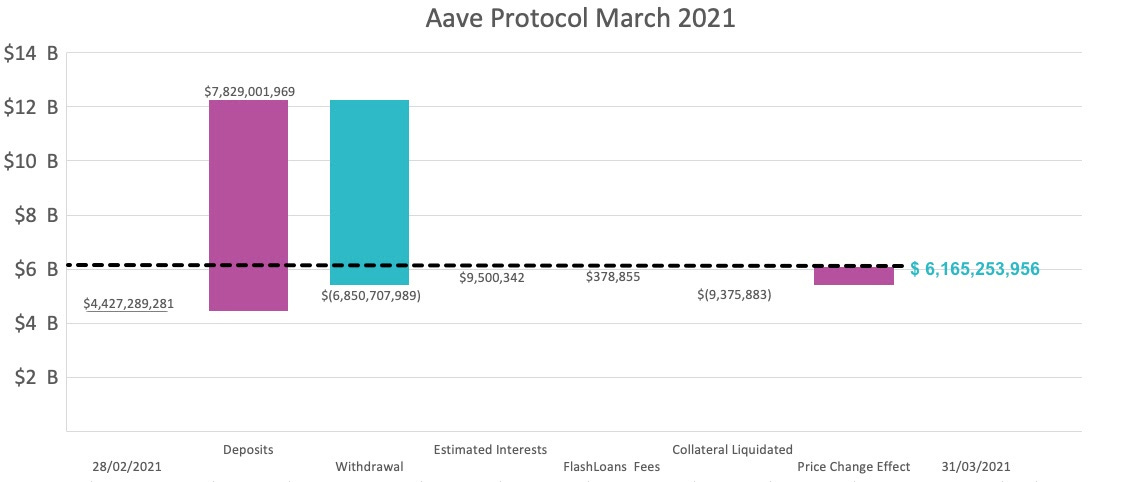

March flew by with many community events and discussions. The Aave Protocol surpassed $6B in total deposits and borrowings (aka ‘market size’) and the AMM Pool alone grew to over $60M.

Aave Protocol Market Size

Technical & Development Updates

March was an exciting month with the release of the AMM Pool where users can use their LP tokens from both Uniswap v2 and Balancer as collateral. The AMM Pool marks the first phase in the multi-market approach. Soon the AMM liquidity pools will be released to Aave Governance, and the Aave Community will decide what comes next. Feel free to write proposals for new collaterals and AMM protocols on the governance forum.

Yesterday it was announced that new scalability frontiers will be explored starting with Polygon (formerly known as Matic), a sidechain of Ethereum that allows for fast and cheap transactions. DeFi composability is one of the ecosystem’s greatest assets, and users should be able to choose whichever scalability solution they prefer. A smart contract bridge will soon be available for users that wish to take their assets to Polygon.

Governance & AIPs

The following proposals have been made in the governance forum:

Allow users to vote with AAVE, stkAAVE and aAAVE. Approximately 11,8% of AAVE in total circulation are aAAVE. Most users use their AAVE as a collateral, and they should be included in the governance process.

Yearn offered to deepen the cooperation with Aave

Proposal to “strengthen the symbiotic relationship between Aave and Yearn”. Yearn will deposit 1,000 freshly minted YFI on Aave and we will offer different advantages. Community did not approve the terms of the proposition.

Introduce Liquidity Incentives for Aave v2

A proposition to incentivise liquidity depositors via liquidity mining. This will concern the stable coin, WBTC and ETH pools, with vesting on the tokens farmed. Feel free to leave your feedback on this proposal and others on the governance forum.

Additional tokens and pools mentioned in forum :

Pools: Curve, Set, Pie DAO

Tokens: UMA, CEL, 1INCH, THOR, FARM, BOND

Events & Community

Throughout March, we teamed up with Covalent for an epic ‘Dungeons & Data’ crypto-data competition where data scientists, devs, puzzle solvers, artists, and more came together for different challenges. Check out the winners here!

Other notable community events and appearances from March to check out include this episode of Base Layer, the incredible hacks that came out of ETHGlobal’s NFT Hackathon, and this talk at the Blockchain Africa Conference.

The Chainlink Hackathon is well underway, and we are excited to see what the talented hackers #BUIDL.

In case you missed the Aave Community Call yesterday, check out the full video here!

Integrations

Taurus integrated Aave Protocol V1 & V2 in their custody solution, allowing banks and exchanges to deposit and borrow digital assets. Enzyme also integrated the protocol, enabling Enzyme Vault Managers to access Aave depositing. Finally, Dharma made Aave deposits possible directly from your bank account.

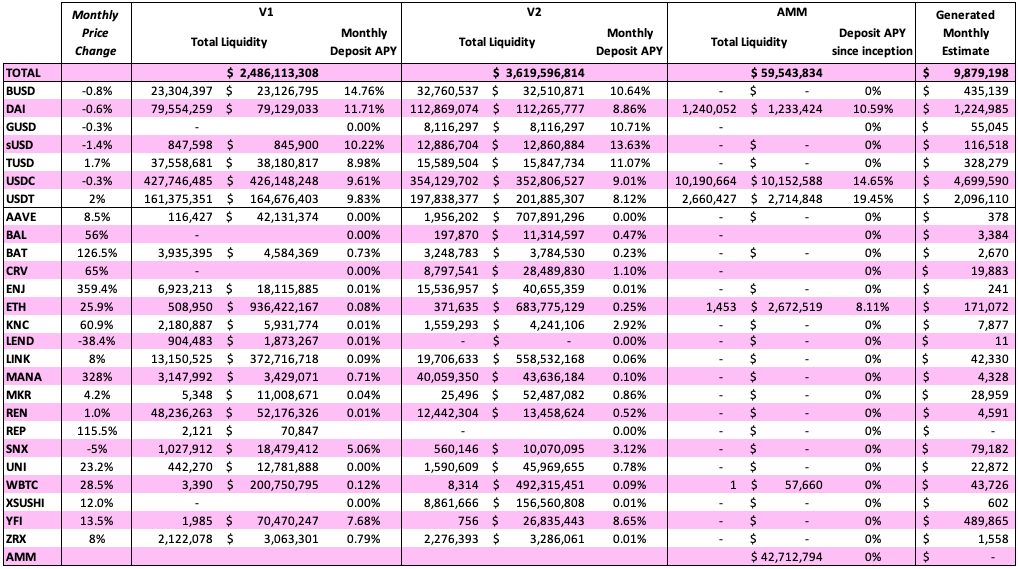

Monthly Metrics

Aave Protocol liquidity has grown 39% this month, now surpassing $6 billion. This is driven by organic growth of V1 and V2 as well as the new AMM Market for liquidity pool tokens, which already holds $60 million. Liquidity has been well utilised, generating a record level of interests and Flash Loan fees nearly reaching $10 million.

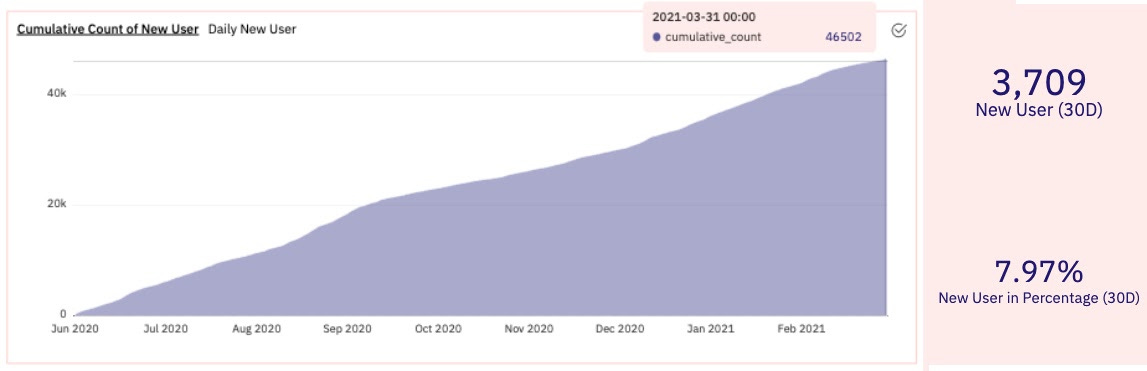

The new Aave Growth Dashboard built by Omni Analytics presents some key metrics to understand the Protocol’s usage. Over 46,000 users have interacted with Aave, with 8% of users new this month. A total of 655,560 transactions have been processed, representing $88 billion of volume of which 18% occurred in March.

Join us and stay tuned

Keep up with all things Aave by following us on twitter or hop into the official Discord channel.

Cheers,

Aave Team