Hello Aave Community!

July has been a wild ride, and we’ve reached so many milestones! Market size looking like a million bucks (well, more like $500M!). We also dropped some plans for native Credit Delegation, which will open up DeFi to the rest of the financial debt market, making DeFi a source of liquidity interoperable with OldFi. We also had some exciting new features and listings: $ENJ and $REN were added to the Aave Market as well as a Fiat to Crypto onramp powered by Transak. Last but certainly not least, the Aavenomics was released, an important step towards putting the decisional power in the hands of the Aave community.

Technical & Development Updates

We released documentation that takes a deep look at liquidity risk and the mitigation techniques in place, which you can read all about here.

Additionally, two new assets were added to the Aave Market: $ENJ and $REN. Finally, a Fiat to Yield onramp has been added, so users can purchase assets in Aave with their credit card without ever leaving the DApp, making the whole DeFi onboarding experience much more seamless.

We can’t wait to hear your feedback on the Aavenomics, as well as the other recent updates! Check out our blog post for the Flash Paper on Aavenomics, or if you’re a huge Aaveconomist, you can find the unabridged version here.

Events & Community

The big one this month was Unitize 2020, and we loved seeing everyone at our booth and talk! Stani also made an appearance on the Layer1 show to talk DeFi vs. CeFi, Yield Farming, and the potential for a DeFi “credit bubble”. Marc Zeller made an appearance on Swapzone’s Cryptocurrency Interview series and Isa Kivlighan gave her first ever talk about Aave at the Berchain event “DeFi-- The Intersection of Fintech and the Decentralized World”.

Stani on the panel “Prophesizing the Future of Oracles”

Up next, catch us at EDCON, SEA DeFi Week 2 (coming back for more!), Korea DeFi Roadshow 2020, Chainlink’s Smart Contract Summit, and more!

We also wrapped up Round 1 of our Ecosystem Grants and kicked off Round 2! If you want to learn more about the grants from round 1 or you’re interested in applying for round 2, this blog post has it all.

Don’t Miss Out On:

This article from The Block on the recent 3 Arrows Capital and Framework Ventures investment

CoinMarketCap’s Cha-Cha-Chat episode on LEND

Integrations

There are more ways to use Aave than ever! Recent integrations include Token Pocket, MEET.ONE, Opyn, Rotki, and Yswap.

Monthly Metrics

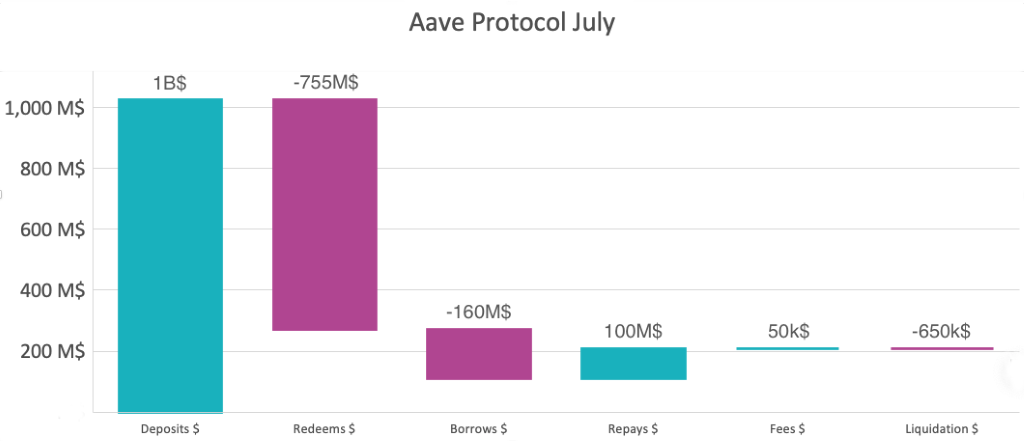

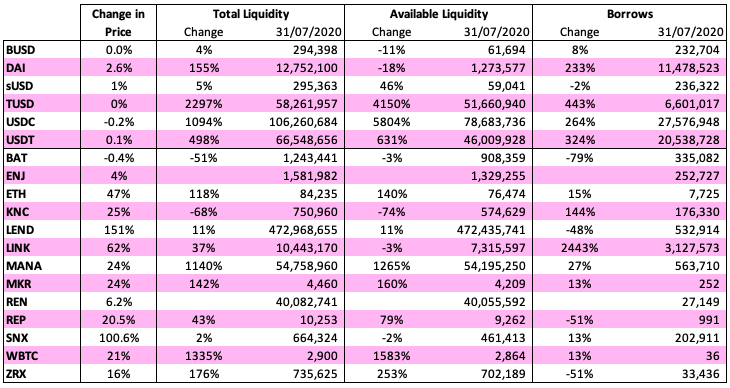

* rounded figures from https://explore.duneanalytics.com/dashboard/aave-monthly-volume-in-

July has been the most active month for the Aave Protocol, with over 1B$ of deposits and volumes greater than those of all previous months combined. These deposits and increased usage have been driven in part by yearn.finance and reinforced by positive price action across Aave assets.

The protocol has witnessed exceptional activity peaking the week of July 20th-26th. This was first driven by the launch and huge success of yearn. Additionally, DeFi users borrowed on Aave to take advantage of Yield Farming opportunities on other platforms driving the utilization up, particularly for the DAI liquidity that was fully utilized. In parallel, a market correction for LEND and LINK at the end of the week resulted in some liquidations on Aave and record Flash Loan volume for liquidations on other platforms.

Join us and stay tuned...

Everyone reading this is an integral part of the Aave Fam, and we’re happy you’re with us on our journey towards a more decentralized governance.

Follow us on twitter for the regular updates or jump into our Discord!

Cheers,

Aave Team