Hello Aave Community!

Hope your 2021 has been off to a good start! On January 8th we celebrated the 1st birthday of the Aave Protocol with a momentous $3B market size milestone and an epic Aaveversary community call. The first year was an incredible journey and it’s all because of you all!

Technical & Development Updates

Aave V2 has been rapidly growing since it launched, and just yesterday the migration tool to migrate your full positions from V1--> V2 was released. The migration tool is powered by Flash Loans, enabling users to migrate, even those with loan positions opened. Head over to your V1 dashboard to migrate and catch you in V2!

Governance & AIPs

The AIP for the Aavenomics Quarterly Upgrade passed with an overwhelming “yae” governance vote and was executed on January 10th. This upgrade activated stake slashing and increased the Safety Incentives from 400 AAVE/day to 550 AAVE/day to be distributed amongst all stakers (a whopping 37.5% raise!).

Events & Community

This month MarketMake hackathon kicked off, powered by Aave and ETHGlobal. Be sure to catch the remaining MarketMake talks 👀

Can’t wait to see what all the talented hackers #BUIDL!

Don’t miss out on:

Learn how depositing, aTokens, and borrowing works in the Aave Protocol in this 1 minute video: Aave Explained 👻

This epic history of Aave video by Finematics: AAVE - The Road To $3 Billion - DEFI Explained

The special Aaveversary episode of Crypto Unstacked with Leslie Lamb

Catch up on or re-watch events on the Aave YouTube channel!

Integrations

Some of the latest Aave Protocol V2 integrations are Parsiq and Cryptofees.info. Parsiq allows you to monitor Aave Protocol V2 events like depositing, borrowing, withdrawals, and repays. Crypto Fees is a cool way to see which crypto projects are being used by tracking the fees.

Monthly Metrics

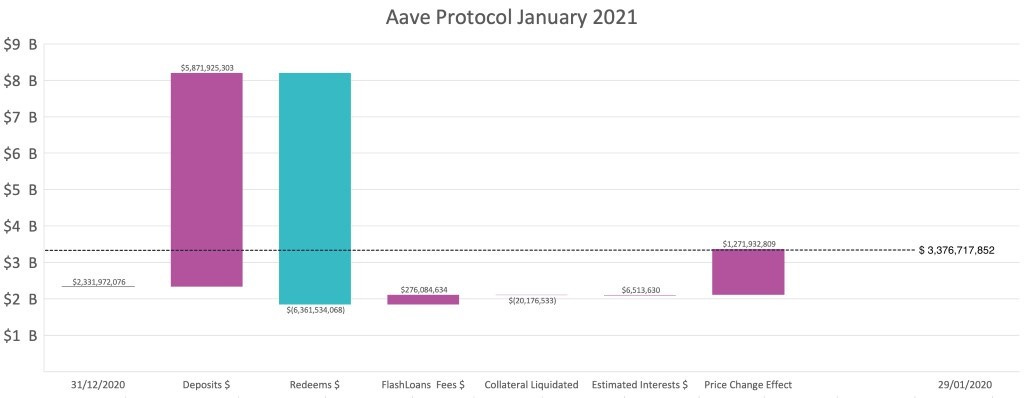

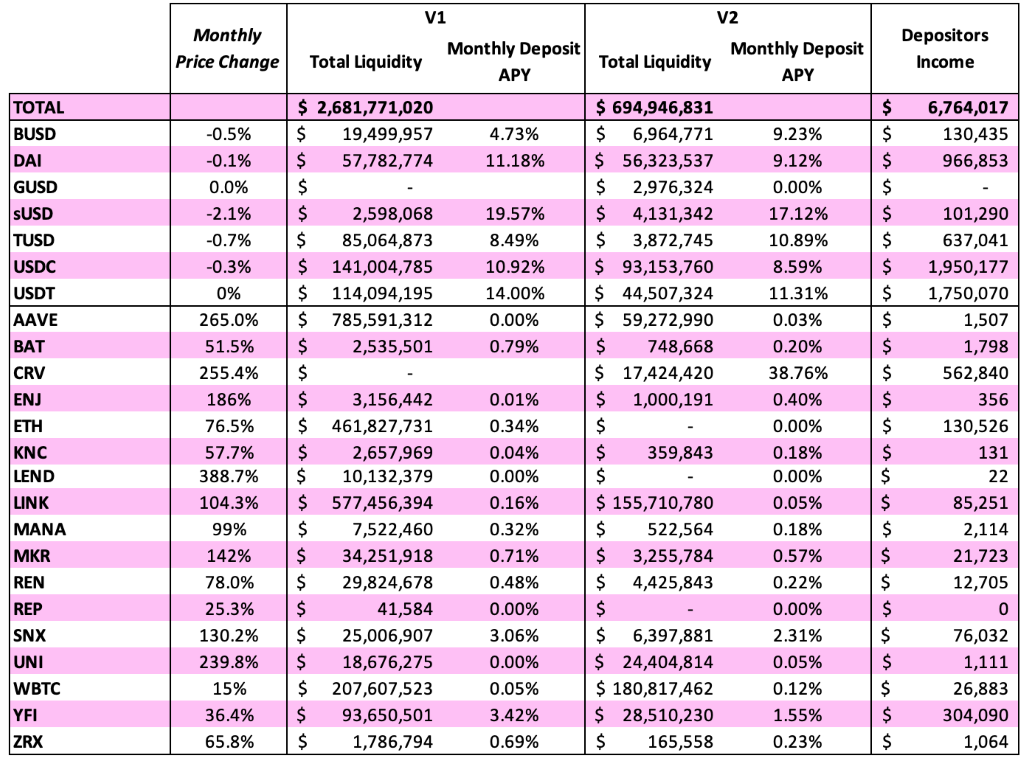

January has been a month of growth for Aave driven by positive price action. Liquidity has been migrating from V1 to V2 which now holds $700 million of liquidity with $3.4 billion of liquidity across the protocol. This is accompanied by good utilisation of the reserves, with a record of $800 million of outstanding loans, bringing in nearly $ 7 million to depositors. USDC, USDT and DAI are the top revenue generators.

Join us and stay tuned

Aave is excited to sponsor ETHDenver in February! Apply to hack now ⚒️

Also, in case you haven’t heard, the Aave Fam is hiring!

If this sounds like you, feel free to shoot an email at wecare@aave.com.

Be sure to keep up with the Aavesome events and updates coming up in February by following Aave on Twitter or joining the Discord server!

Cheers,

Aave Team