Hello Aave Community!

April was an exciting month full with new governance proposals votes. This excitement was reflected in the Aave Protocol’s growth this month, as the protocol surpassed $14B in market size.

Technical & Development Updates

New scalability frontiers opened up for the protocol, which started with Polygon (formerly Matic), making it easier and cheaper than ever to interact with the protocol. Shortly after, Polygon introduced liquidity mining $MATIC rewards for users depositing and borrowing in the Polygon Aave Market to bootstrap the growth of their ecosystem.

Governance & AIPs

AIP 11: The Aave community approved a proposal to disable new stable loans on Aave v1 and added a condition where stable loans temporarily switch to variable loans if the interest rates reach a high level.

AIP13: The Aave community voted on and approved a proposal to add $renFIL to the Aave liquidity pool, and the following AIP enabled renFIL borrowing.

AIP16: The Aave community approved a liquidity mining proposal from ParaFi to distribute 2200 stkAAVE/day between depositors and borrowers on Aave v2. All Aave v2 users will now have stkAAVE, meaning they can participate in the governance and earn Safety Incentives for securing the protocol.

Events & Community

Chainlink Hackathon

Aave sponsored the Chainlink hackathon, and 3 projects were chosen as the Aave hack winners:

🏆First place went to Parametric Digital Asset Risk Management, a platform to offer lending protection to users concerned with losing their digital assets to hacks or other events. Learn more about the project here.

🏆Second prize was awarded to Vulcan Exchange, an exchange for weather derivatives. The collateral of the weather derivatives is deposited in Aave and the interest earned is used to reward derivative buyers, and the one and only Marc Cuban was just announced as a strategic advisor! Check it out here.

🏆Third prize went to Boto, a platform with the goal to create a community where developers and non-devs (through drag-and-drop) can create and share their bots. They’re currently working on an MVP to go live this summer. Stay tuned and check out Boto’s website here.

Aave hosted a panel on ‘Institutional Adoption of DeFi’ as well as a webinar on ‘NFTs in Decentralised Finance’ with Cryptocompare. Additionally, Aave introduced DeFi to an enterprise audience at the Enterprise Ethereum Alliance Conference.

Integrations

Pool Together released the first Aave-powered no-loss prize pool on Polygon. Curve Finance also launched a pool on Polygon, which is deposited into Aave. Users can swap between $DAI, $USDT, and $USDC and earn trading fees and $MATIC. Instadapp released a tool to seamlessly migrate your Aave L1 positions over to Polygon with just 1 click. DeFi Saver launched a migration tool to move from Aave Protocol v1 to Aave Protocol v2. Finoa integrated AAVE custody support for institutions, and dydx introduced an AAVE perpetual market.

Monthly Metrics

The Aave Protocol closes the month of April climbing at the top of the DeFiLlama TVL ranking with $10 Billion of Total Value Locked.

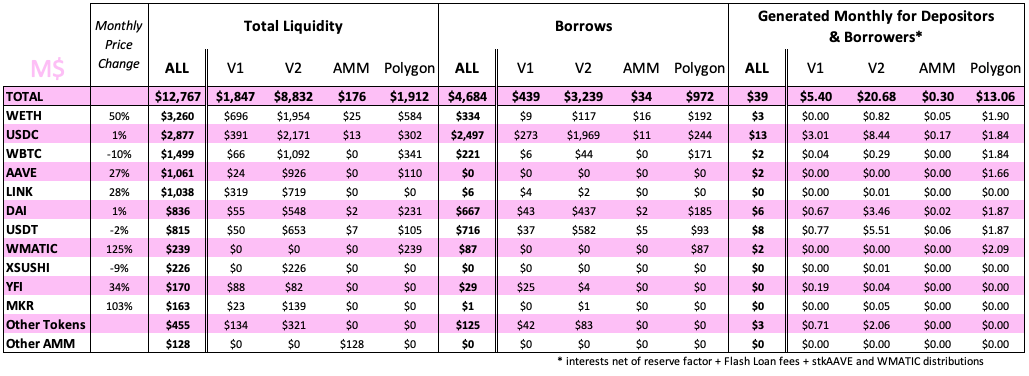

In April, the Aave Polygon market gained mass adoption with 11,000 users and 7,000 borrowers in just a month. In parallel, the market reached $2 billion of liquidity with $1 billion of outstanding loans; generating $13m for depositors and borrowers. This includes interests net of reserve factor, Flash Loan fees and $WMATIC distribution.

The Aave Protocol V2 Market also experienced exceptional growth to $9 billion of liquidity as users migrate from V1 (you can use the migration tool), generating $21m for depositors and borrowers - interests net of reserve factor, Flash Loan fees and $stkAAVE distribution.

The markets together reached $13 billion of liquidity +68% this month, provided by over 24,000 users. There are currently over 12,000 borrowers on the Aave Protocol pushing borrowing to the record level of $5 billion of outstanding loans. The reserve factor collected on the interests $1 million for the ecosystem.

Join us and stay tuned

Be part of the Aave Community on Discord and follow Aave on twitter for regular updates.

Cheers,

Aave Team